Open up Doorway Loans and doorstep hard cash lending have acquired popularity as easy and flexible options for individuals looking for speedy fiscal aid. A lot of these lending products and services enable borrowers to entry hard cash without having to undergo the traditional, frequently prolonged, mortgage software procedures affiliated with banking companies or other large monetary establishments. Though the appeal of these kinds of financial loans could lie within their simplicity and accessibility, it’s crucial to completely recognize the mechanisms, benefits, and opportunity pitfalls in advance of thinking of this sort of monetary arrangement.

The strategy powering open door financial loans revolves close to supplying straightforward and rapid entry to resources, usually without the need to have for comprehensive credit history checks or collateral. This can make these financial loans attractive to people who may not have the most beneficial credit score scores or individuals that encounter economic complications. As opposed to classic loans that could just take days or perhaps months to generally be approved, open doorway financial loans generally provide money into the borrower’s account inside of a make a difference of hours. This velocity and convenience are two of your most important things contributing into the rising attractiveness of those lending services.

The entire process of applying for these financial loans is easy. Typically, borrowers will need to offer simple personalized details, evidence of cash flow, and bank information. Given that open up doorway loans are generally unsecured, lenders tackle extra possibility by not demanding collateral. As a result, the desire charges and costs connected to these financial loans are typically increased in comparison to conventional lending selections. Even though this can be a disadvantage, the accessibility and speed of funding generally outweigh the higher prices For several borrowers in urgent money predicaments.

Doorstep cash lending, because the title indicates, entails the shipping of money straight to the borrower’s home. This service is built to cater to These who prefer in-man or woman transactions or individuals that may not have usage of on the net banking facilities. A representative through the lending firm will visit the borrower’s household handy in excess of the dollars and, in several circumstances, collect repayments on a weekly or month-to-month basis. This own contact can offer a way of reassurance to borrowers, Primarily those who can be wary of online transactions or are a lot less knowledgeable about electronic economical expert services.

Nevertheless, a person will have to look at the higher fascination premiums and fees often associated with doorstep funds lending. These types of financial loans are deemed high-risk by lenders, provided that they are unsecured and that repayment collection relies upon heavily within the borrower’s capacity to make payments after a while. As a result, the desire rates billed can be significantly bigger than People of standard financial loans. Borrowers needs to be careful of the, because the comfort of doorstep income lending may possibly arrive at a substantial cost.

An additional aspect to contemplate is definitely the repayment flexibility that these financial loans give. Numerous open up door financial loans and doorstep income lending providers give adaptable repayment options, that may be valuable for borrowers who will not be capable of decide to rigid payment schedules. Even so, this overall flexibility may also produce lengthier repayment intervals, which, coupled with high desire prices, may cause the borrower to pay for considerably a lot more about the life of the loan than they at first borrowed. It’s crucial that you evaluate whether or not the repayment framework of such financial loans is actually workable and in keeping with just one’s financial predicament right before committing.

One of the important factors of open doorway loans is their capability to accommodate people with lousy credit history scores. Conventional financial institutions often deny financial loans to Individuals with a lot less-than-perfect credit rating histories, but open up doorway lenders usually aim much more over the borrower’s current ability to repay rather than their credit past. While This may be useful for all those trying to rebuild their fiscal standing, it’s critical being conscious of the challenges included. Failing to fulfill repayment deadlines can even further problems one’s credit score and most likely cause much more intense economical complications down the road.

The approval process for these loans is usually rapid, with selections manufactured in just a few several hours, and funds are sometimes available the exact same day or the next. This immediacy would make these loans a lifeline for persons dealing with unexpected fees or emergencies, for instance vehicle repairs, medical bills, or other unexpected financial obligations. Having said that, the ease of access to cash can from time to time bring about impulsive borrowing, which could exacerbate economical troubles as an alternative to take care of them. Borrowers ought to often take into consideration whether or not they actually have to have the mortgage and if they can afford to pay for the repayments ahead of continuing.

A further advantage of doorstep cash lending is it allows borrowers to get money with no need to visit a financial institution or an ATM. This may be especially handy for those who could are in distant locations or have restricted use of fiscal establishments. On top of that, some borrowers could sense more comfy coping with a representative in particular person, particularly if they may have concerns about managing money transactions on line. The non-public character on the provider can foster a more powerful romantic relationship among the lender as well as the borrower, but it is critical to remember that the significant cost of borrowing continues to be a major thing to consider.

There is certainly also a particular volume of discretion associated with doorstep cash lending. For individuals who might not want to reveal their financial predicament to Many others, the ability to deal with bank loan preparations with the privateness of their household is often appealing. The personal conversation which has a lender agent might also provide some reassurance, as borrowers can discuss any considerations or queries instantly with the individual delivering the loan. This immediate communication can sometimes make the lending system sense considerably less impersonal than managing a faceless on the net software.

To the downside, the ease of doorstep dollars lending can at times result in borrowers getting out multiple loans concurrently, particularly if they discover it challenging to maintain up with repayments. This may develop a cycle of financial debt that may be challenging to escape from, specifically Should the borrower will not be controlling their funds cautiously. Dependable borrowing and a clear understanding of the personal loan phrases are vital to stay away from these cases. Lenders may well present repayment programs that appear versatile, however the significant-desire rates can accumulate immediately, resulting in a big credit card debt burden eventually.

Although open doorway financial loans and doorstep funds lending provide several Advantages, for instance accessibility, velocity, and flexibility, they aren't devoid of their difficulties. Borrowers must thoroughly assess the stipulations of these loans to prevent acquiring caught in the credit card debt cycle. The temptation of swift funds can from time to time overshadow the extensive-expression money implications, significantly If your borrower will not be in a robust place to create well timed repayments.

One among the principal concerns for virtually any borrower really should be the entire expense of the mortgage, together with curiosity premiums and any extra expenses. Whilst the upfront simplicity of those financial loans is pleasing, the particular sum repaid eventually may be drastically bigger than expected. Borrowers must weigh the quick advantages of getting income swiftly versus the long-term financial impact, specially In the event the financial loan phrases increase in excess of several months as well as yrs.

Furthermore, borrowers also needs to be aware of any opportunity penalties for late or skipped payments. Several lenders impose steep fines for delayed repayments, which may further more raise the full cost of the financial loan. This makes it a lot more vital for borrowers in order that no refusal loans uk direct lenders they've a solid repayment system set up before taking out an open door mortgage or choosing doorstep income lending.

Despite the probable negatives, there are eventualities where open up door financial loans and doorstep cash lending can be beneficial. For people who will need entry to funds immediately and do not need other viable financial alternatives, these financial loans give an alternative which will help bridge the gap all through hard occasions. The important thing is to employ these loans responsibly and guarantee that they're A part of a very well-thought-out fiscal system as opposed to a hasty conclusion pushed by speedy requirements.

In some instances, borrowers may possibly notice that these financial loans serve as a stepping stone to a lot more stable financial footing. By making timely repayments, individuals can demonstrate fiscal duty, which may improve their credit history scores and allow them to qualify For additional favorable financial loan phrases in the future. Having said that, this result depends closely over the borrower’s power to deal with the mortgage effectively and stay away from the pitfalls of high-fascination debt.

It’s also worthy of noting that open door financial loans and doorstep cash lending in many cases are topic to regulation by economical authorities in various countries. Lenders need to adhere to selected guidelines relating to transparency, curiosity costs, and repayment phrases. Borrowers need to make sure that they're managing a respectable and regulated lender to prevent likely cons or unethical lending procedures. Examining the lender’s qualifications and studying evaluations from other borrowers may help mitigate the potential risk of falling target to predatory lending schemes.

In conclusion, open door financial loans and doorstep money lending give a hassle-free and obtainable Answer for individuals dealing with instant fiscal worries. Though the benefit of obtaining these loans could be appealing, it’s very important to method them with caution and a clear idea of the linked charges and risks. Borrowers really should carefully Examine their ability to repay the loan throughout the agreed-upon terms and be familiar with the potential lengthy-phrase economical outcomes. By doing this, they will make knowledgeable choices that align with their economic objectives and avoid the common pitfalls of high-desire lending.

Mara Wilson Then & Now!

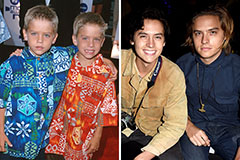

Mara Wilson Then & Now! Dylan and Cole Sprouse Then & Now!

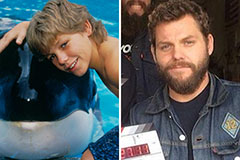

Dylan and Cole Sprouse Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Molly Ringwald Then & Now!

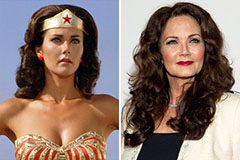

Molly Ringwald Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now!